Image

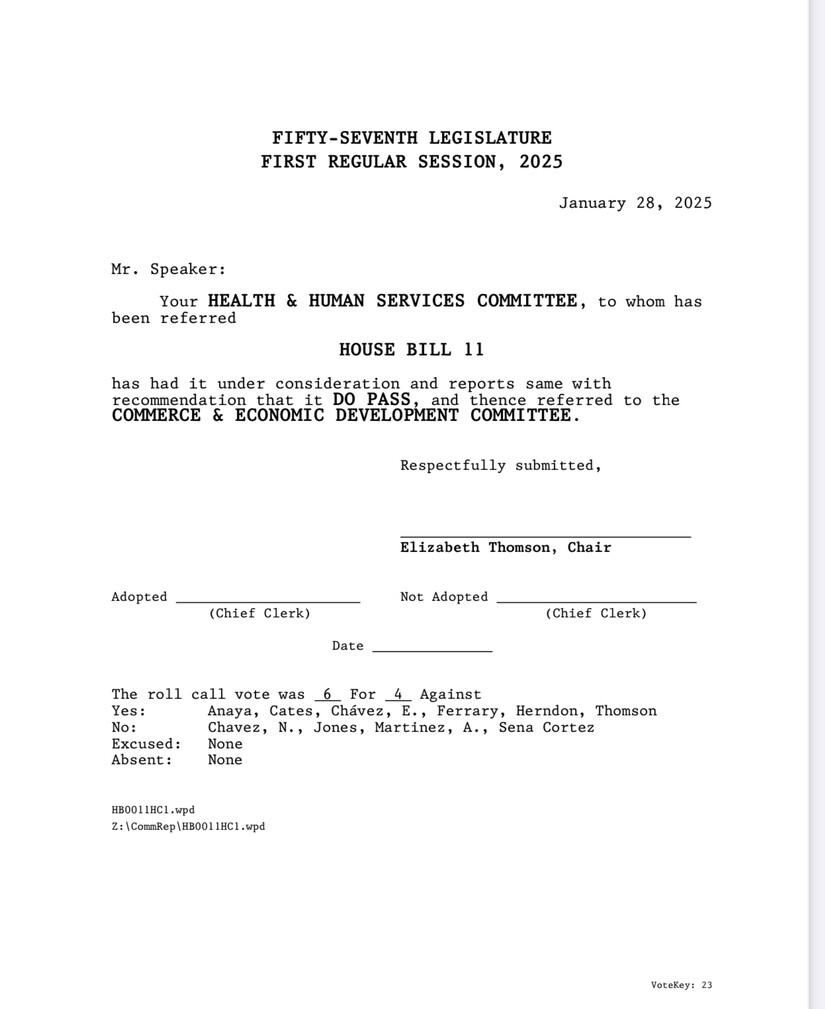

New Mexico's HB 11 PAID FAMILY & MEDICAL LEAVE ACT after 2 hours of debate and public comment has now passed the first committee hurdle on a split vote of 6 to 4 and now moves forward. This controversial bill to business would add an additional tax to workers and to businesses owners with a strain on lower income earners and businesses with 5 or more employees.

Per New Mexico Legislative Analysis , the proposed house led legislation would create a state-run Paid Family and Medical Leave (PFML) fund. This state managed fund would provide eligible employees with up to 12 weeks of paid leave for qualifying medical and family reasons. The program is intended to be funded by a mandatory payroll tax on both employees and employers with five or more employees. The Legislative Finance Analysis estimates the fiscal impact of the program to be over $400 million, establishing it as one of the most expensive employer related measures in New Mexico’s history. The bill passed its first committee on a partisan vote, with all Democrats supporting it and all Republicans opposing it.

New Mexico House Bill 11 is proposed to be financed through a mandatory payroll tax imposed on both employees and employers. Under the most current proposal, employees would contribute 0.5% of their wages, equivalent to $5 for every $1,000 earned, while employers with five or more employees would pay 0.4% of their payroll, or $4 for every $1,000 paid to employees. The total payroll tax burden would be 0.9% of wages, deducted from paychecks along with employer contributions.

Advocates such as the New Mexico Native Vote organization endorsed the measure claiming; "HB11 would implement Paid Family and Medical Leave (PFML) for employees in the state of New Mexico who may be welcoming a child, managing a serious medical condition for themselves or a family member, child bereavement, military exigency, or those who have been impacted by domestic or sexual violence for up to 12 weeks.

Some of the benefits include increased workforce participation, positive effects on recruitment, retention, morale, and workplace satisfaction. It also reduces infant mortality, child abuse, nursing home usage, and enhances parental physical and mental wellbeing.

HB 11 is funded through employee and employer contributions whereas employees pay at the rate of $4 per $1000 of wages per year and employers pay $5 per $1000 of wages. Employers with 5 or more employees would pay into the fund while 66% of NM employers won't have to pay anything. It's good for New Mexico families.

Many business organizations and other groups are opposed to NM HB 11 citing the expense and the fear of cost overruns. Opposition is led by the New Mexico Chambet of Commerce and the New Mexico Business Coalition. The NMBC says, "with inflation hitting hard and many businesses barely staying afloat, this new tax could be the final nail in the coffin – forcing mass layoffs and closures across New Mexico." Read NMBC’s complete commentary and other issues with this bill HERE.

NMHB-11 has just 7 weeks to make it through the various committees and 2 chambers of the legislature. Last year a similar proposal lost by just two votes. Stay tuned for further updates...