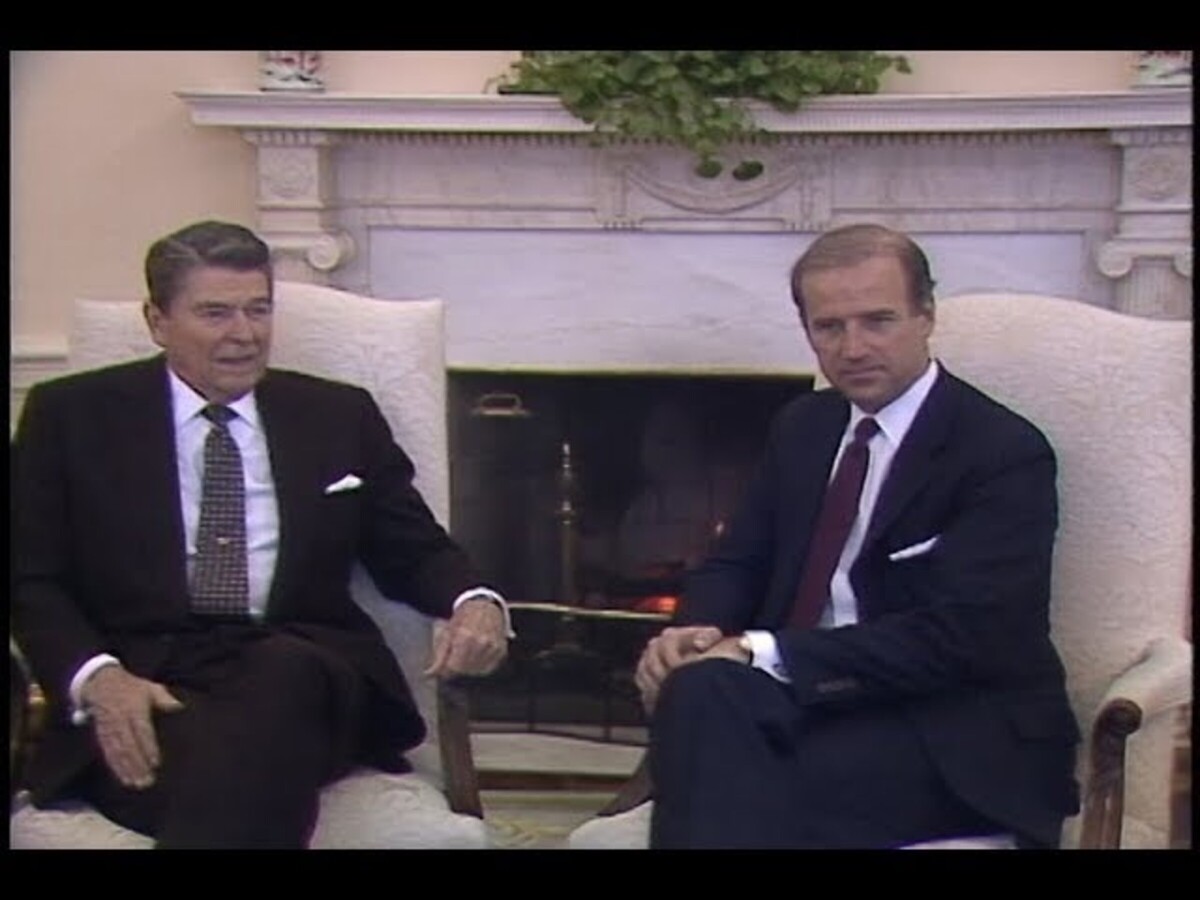

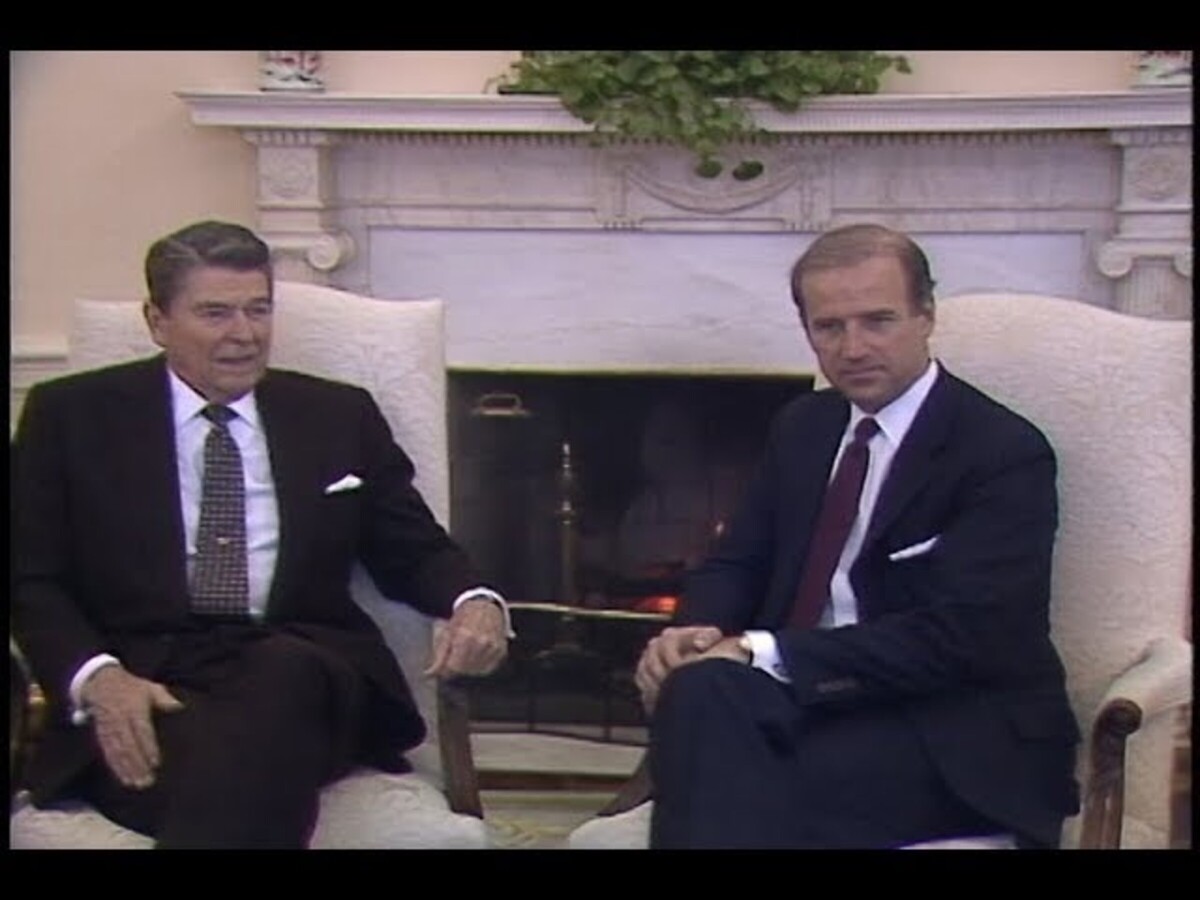

Image

A lesson from the Reagan's tax cuts in 1981 constituted the strongest move away from progressivity in the income tax since the tax was initiated in the Civil War.

The Democrats are proposing a Federal budget doing it with the same process that was used to set that direction four decades ago when first-year President Ronald Reagan used reconciliation to achieve his "revolution" in federal fiscal policy in 1981.

The Reagan years were the culmination of rising anti-tax sentiment in the late 1970s, when some states adopted tax limitations by popular referendum. That spirit was kept alive in the decades to come by groups such as Americans for Tax Reform, led by activist Grover Norquist. Starting in 1986, Norquist has challenged candidates for office to sign his "taxpayer protection pledge" not to raise taxes. The great majority of Republicans have signed.

Reagan was able to reverse what had been a decades-long commitment to at least the look of progressivity. He could do it in part because his 1980 election coattails enabled his party to capture control of the Senate for the first time in a quarter century. Moreover, while Democrats still had a House majority, their ranks included scores of members from Southern and Midwestern districts that had also voted for Reagan.

When the budget resolution passed in that summer of 1981, 63 House Democrats joined all 190 Republicans in backing it. And when the tax package came to its critical votes in July, dozens of Democrats sided with Reagan and the Republicans rather than their own leadership.

In 1982, Democrats added to their majority in the House and negotiated some revenue increases with the Senate and the White House. And in Reagan's second term, momentum built quickly for a tax overhaul that would combine still lower marginal rates with new business taxes and a paring back of tax preferences and other "loopholes." The new overhaul's main appeal to Democrats was that it exempted far more middle- and lower-income earners from the income tax altogether.

The Tax Reform Act of 1986 was hailed as a bipartisan wonderment, winning support from bipartisan majorities in a Republican Senate and a Democratic House. Reagan signed it into law, praising the new top rate of 28% and turning a blind eye to the new business levies.

But effects of the act had scarcely begun to be felt when policymakers began chipping away at them. Preferences and other specific provisions for industries or other activities were reinserted in the tax code as lobbying and popular demand took their toll. The top tax rate started creeping back up in the budget compromises of 1990 and 1993, reaching 39.6% in the presidency of Bill Clinton.

The Clinton years saw a robust economy created in part by the personal computer and the burgeoning internet economy. That in turn drove stock prices to historic highs. The higher tax rates on income and capital gains brought new highs in federal revenue collections, and by 2000, the annual federal budget was remarkably close to being balanced.

The Congressional Budget Office even projected a surplus in the coming years of the new century, large enough to start paying down the national debt (which still amounted to less than $6 trillion at that time). As of April 8, 2021, the U.S. national debt is $28.1 trillion and rising.

The Congressional Budget Office estimated that the federal debt held by the public will equal 98.2% of GDP by the end of 2020. As of Q3, 2020, it was 99.4%, with a peak at Q2 of 105%. That is the highest level since 1946.910 Since 1970, when the national debt stood at about 26.7% of GDP, debt has gone through a few different periods, staying fairly steady through the 1970s, rising drastically through the 1980s and early 1990s under the Reagan and Bush Presidencies. It peaked in Q1 1994 at 48.3% of GDP, before falling again under the Clinton administration to a low of 30.9% in Q2 2001. It started climbing under George W. Bush again, slowly at first, and then sharply.

As the financial crisis hit with the worst recession since the Great Depression, government revenues plummeted and stimulus spending surged to stabilize the economy from total ruin. This economic catastrophe, combined with an enormous reduction in revenue from the Bush tax cuts and the continued expenses of the Afghanistan and Iraq Wars, caused the debt to balloon. Under the two terms of the Obama administration, federal debt held by the public rose from 43.8% of GDP in Q4 2008 to 75.9% in Q4 2016, a 73.3% increase.

In 2020, when the COVID-19 pandemic hit and spread unchecked, the U.S. economy was sent into recession. The virus forced widespread quarantines, shutdowns, enormous stimulus and relief expenditures, and drastically lowered government revenue. The level of federal debt held by the public will have grown by approximately 48% under Trump's four years in office.

Economists and policy analysts disagree about the consequences of carrying federal debt. Certain aspects are agreed upon, however. Governments that run fiscal deficits have to make up the difference by borrowing money, which can crowd out capital investment in private markets. Debt securities issued by governments to service their debts have an effect on interest rates. This is one of the key relationships that is manipulated through the Federal Reserve's monetary policy tools.

What are the lesson here? Reconciliation is not something new and it can have long term implications on the budget and the US economy. Republicans used it under Reagan and that template is being used by Biden. Wars are expensive and don’t add value to the US economy. History does have a habit of repeating itself.

NPR, Wikipedia and Reagan Library Archives sourced for parts of this article.