Image

RECA provides one-time payments to people who developed certain illnesses after working in uranium mining/milling/transporting/drilling or being present at nuclear test sites like the Trinity Site.

Am I eligible as a Uranium Worker?

✓ Were you working as a uranium miner who worked more than 1 year or exposed to 40 or more working level months in New Mexico between January 1, 1942 and December 31, 1990?

✓ Were you working as a uranium miller, ore transporter, or core driller who worked for 1 year, in New Mexico between January 1, 1942 and December 31, 1990?

✓ Developed a qualifying disease?

If YES, you may qualify for $100,000 under the expanded RECA program as well as an additional $50,000 plus medical benefits from Energy Employees Occupational Illness Compensation Program Act (EEOICPA).

Am I eligible as an On-Site Participant?

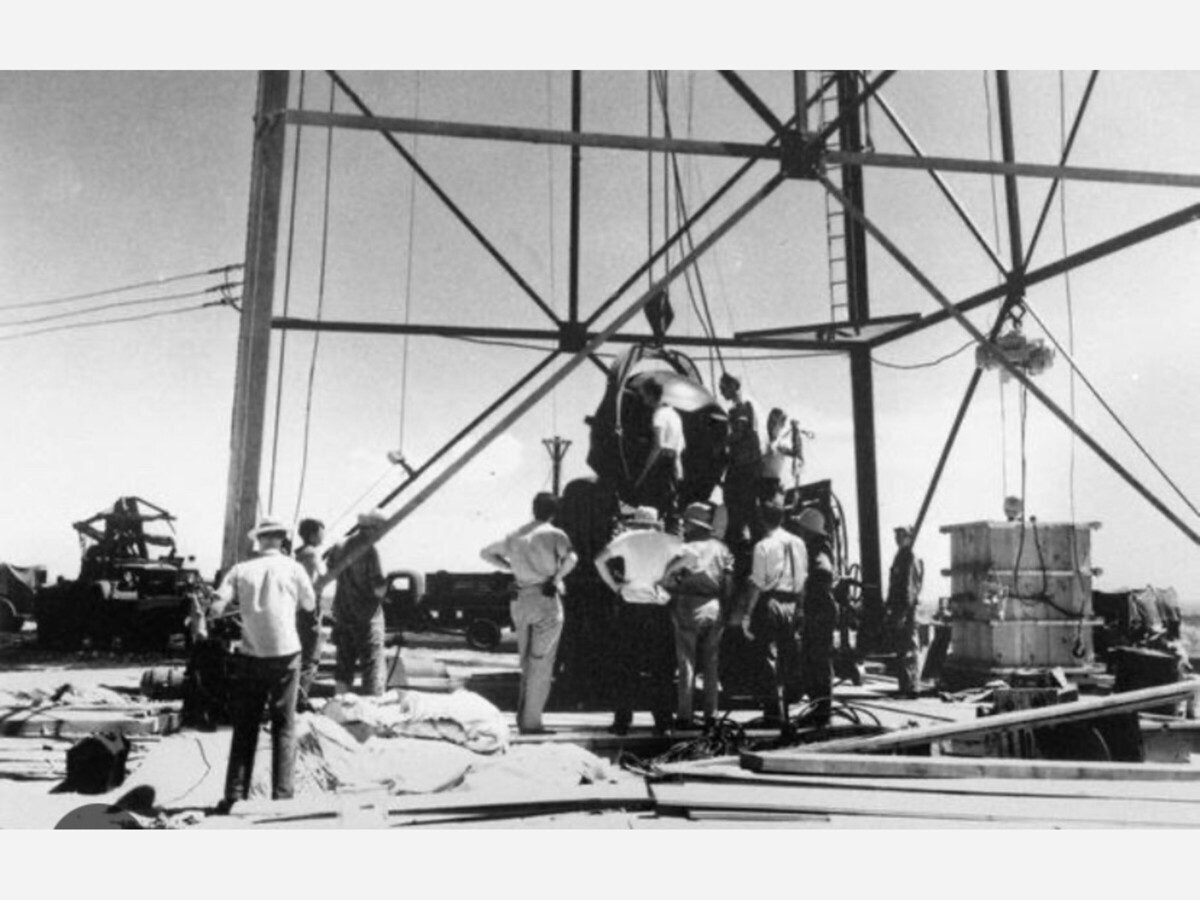

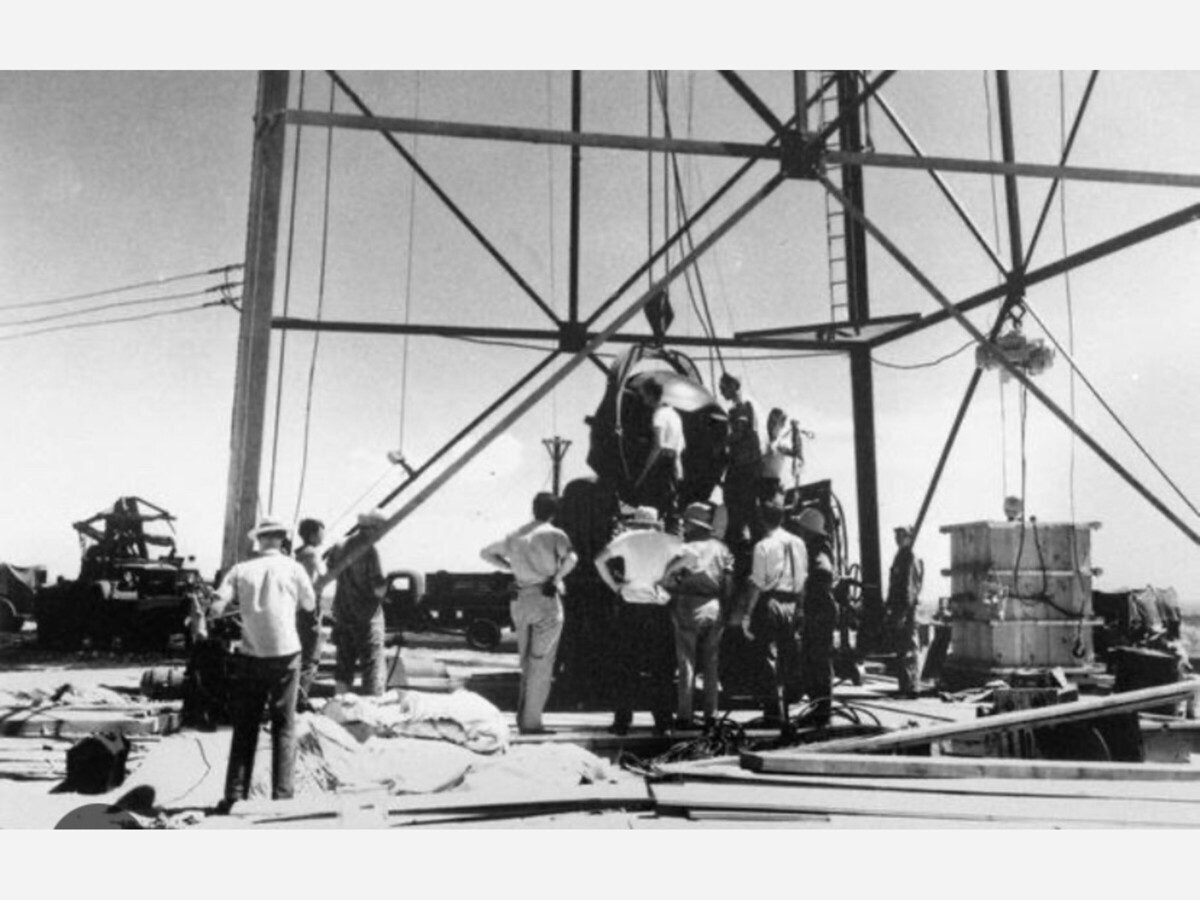

✓ Were you working at or near the Trinity Test Site during the 1945 test or other covered test sites?

✓ Developed a qualifying disease?

If YES, you may qualify for $100,000 under RECA.

What diseases qualify?

For Uranium Workers:

For On-Site Participants:

What documents will I need?

More information will come from DOJ, but generally you will need:

✓ Employment records or affidavits showing uranium work during 1942–1971.

✓ Documentation of participation at the Trinity Site or other test sites if applicable.

✓ Medical records with your diagnosis.

Will I have to pay taxes on my compensation?

No, the compensation will be Federally tax-free and it does not affect Social Security or Medicaid eligibility).

How do I apply?

The Department of Justice will update its RECA process for these new eligibility categories.

Gather your records now so you can apply promptly when available.

Your work and sacrifice matter. Take the first step to claim the compensation you and your family deserve.

Know Your Rights: Attorney Fees

You do not need a lawyer to claim eligible compensation through the Radiation Exposure Compensation Act. If you choose to acquire a lawyer, please note:

Notwithstanding any contract and except as provided in paragraph (b)(3) of this section, the attorney of a claimant or beneficiary, along with any assistants or experts retained by the attorney on behalf of the claimant or beneficiary, may receive from a claimant or beneficiary no more than 2% of the total award for all services rendered in connection with a successful claim, exclusive of costs. (3)

(i) If an attorney entered into a contract with the claimant or beneficiary for services before July 10, 2000, with respect to a particular claim, then that attorney may receive up to 10% of the total award for services rendered in connection with a successful claim, exclusive of costs.

(ii) If an attorney resubmits a previously denied claim, then that attorney may receive up to 10% of the total award to the claimant or beneficiary for services rendered in connection with that subsequently successful claim, exclusive of costs. Resubmission of a previously denied claim includes only those claims that were previously denied and refiled under the Act.

Find more information here.