Image

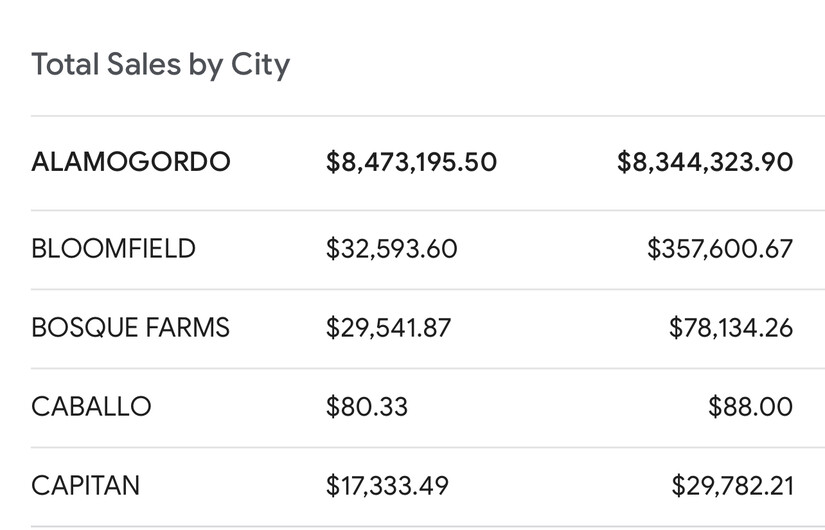

Cannabis sales within Alamogordo is trending at $8.4 Million year to date as of July as reported by the state of New Mexico…

Why are so many dispensaries applying to operate in Alamogordo? Thank the Texans.

While recreational marijuana remains illegal in Texas, it pays to have a store on the border. Alamogordo’s sales of over $8 Million year to date show the impact of Texas Cannabis Tourism.

Recreational marijuana sales in individual border stores outpaced their cohorts in New Mexico's more populous cities such as Albuquerque.

Ultra Health's Sunland Park location sold almost $3.6 million recreational marijuana between August 2022 and February 2023.

Urban Wellness, the top-selling Albuquerque store, brought in $1.95 million for the same time period.

In fact, almost half the top 20 revenue-generating stores in New Mexico are located in cities bordering Texas, such as Anthony, Hobbs and Sunland Park and Hobbs.

At the one year anniversary of legalization of cannabis , the state of New Mexico had issued around 2,000 cannabis licenses, including 633 cannabis retailers, 351 producers, 415 micro producers, and 507 manufacturers.

“In just one year, hundreds of millions of dollars in economic activity has been generated in communities across the state, the number of businesses continues to increase, and thousands of New Mexicans are employed by this new industry,” said Gov. Lujan Grisham. “I’m excited to see what the future holds as we continue to develop an innovative and safe adult-use cannabis industry.”

Monthly sales have remained consistent throughout the last year, with March 2023 marking the highest adult-use sales at $32.3 million. As of March 2023, more than $27 million in cannabis excise taxes has gone to the state general fund and to local communities. To date, the state has recorded more than 10 million transactions. More data on sales and licenses can be found here.

Albuquerque, Las Cruces, and Santa Fe saw the largest number of sales in the first year. Smaller communities, including Clovis, Farmington, and Ruidoso, each saw more than $7 million in adult-use sales. Towns near the Texas border were also positively impacted by the cannabis industry. Sunland Park recorded $19.4 million in adult-use sales.

“From the governor’s signing of the legislation, to standing up the Cannabis Control Division and rolling out this new industry, the New Mexico cannabis industry has shown great promise,” said Regulation and Licensing Department Superintendent Linda Trujillo. “We’re looking forward to even more growth in year two.”

To open a cannabis business in Alamogordo and in New Mexico is expensive. Licensing alone is a cumbersome and expensive process…

New Mexico has created 10 adult-use license types with vertical integration encouraged in several key types. Those license types and fees are as follows:

NOTE: Fees are reduced by half for medical only licensees

For medical cannabis-only operations there is also the New Mexico Licensed Non-Profit Producer (LNPP) license. This is a vertically integrated license, allowing a licensee to grow medical cannabis plants; extract, process and produce medical cannabis products; and dispense to registered patients. There is a limit of thirty-five LNPPs allowed statewide. There are no limits to the number of stand-alone dispensaries each LNPP is allowed to open. The New Mexico has awarded all 35 LNPPs and is no longer accepting applications for additional LNPPs. The LNPP application fee is $10,000; $ 9,000 is returnable if the state denies the applicant.

New Mexico’s recently launched cannabis tax structure is relatively fair and straightforward compared to other states. It starts at a reasonable rate (~20%) for the first several years before increasing incrementally until July 1, 2030. All medical cannabis sales are tax-free.

The business of cannabis is an expensive venture, but with Texas Tourism and the proximity to White Sands National Park and Lincoln National Forest Texas Tourism will continue to grow the Cannabis market in Alamogordo. The Cannabis Market is a boon for local business and sales tax growth.

What new business has driven over $8 Million in revenue to Alamogordo in the last 6 months? Only the industry of healthcare and the military is driving comparable revenues in Alamogordo.

The business of Cannabis is driving tourism growth and tax revenue in Alamogordo in 2023.