Image

The New Mexico legislatures fiscal impact analysists have now completed two separate reports on the John Block sponsored Tax Increase on energy boondoggle.

Links to each analysis are below..

John Block Tax Increase Analysis Kao

Join Block Sponsored Tax Increase Analysis 2 Graeser

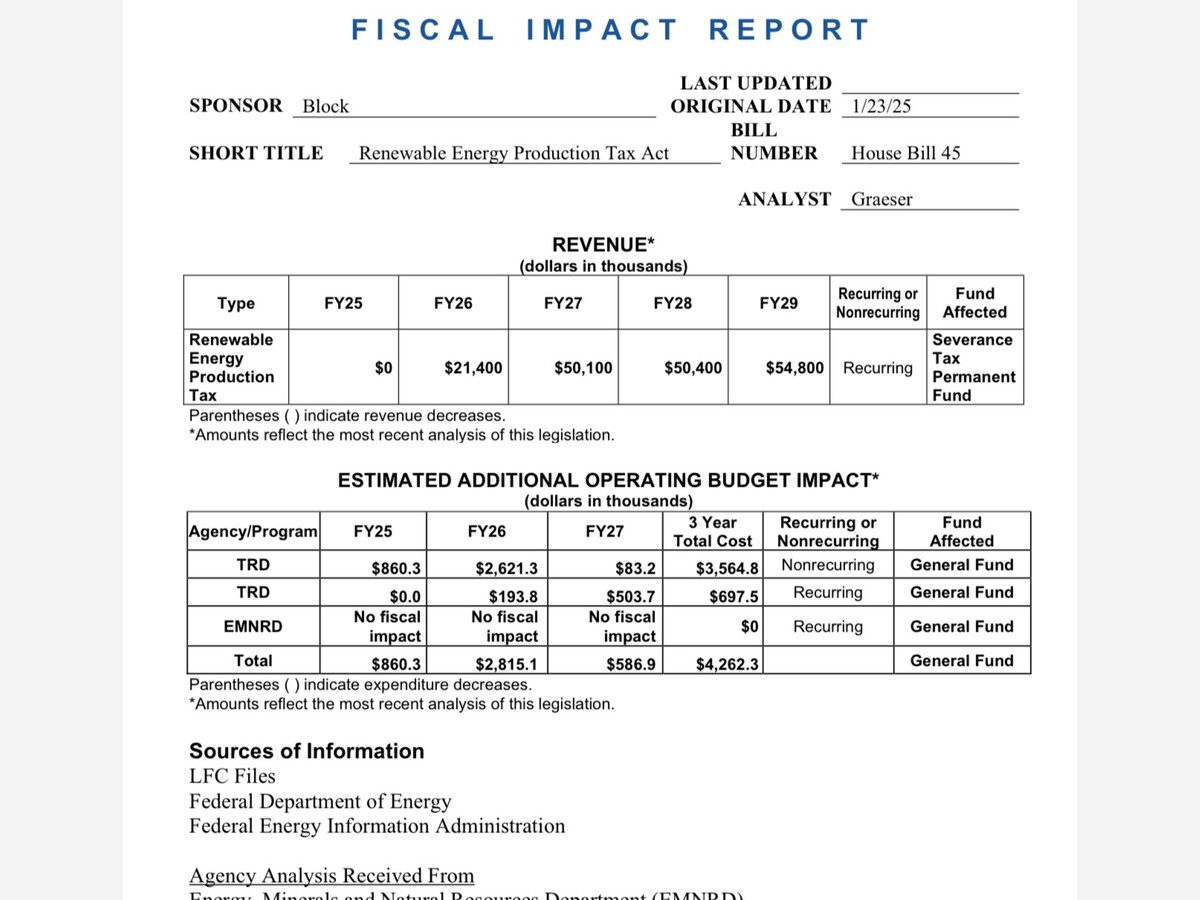

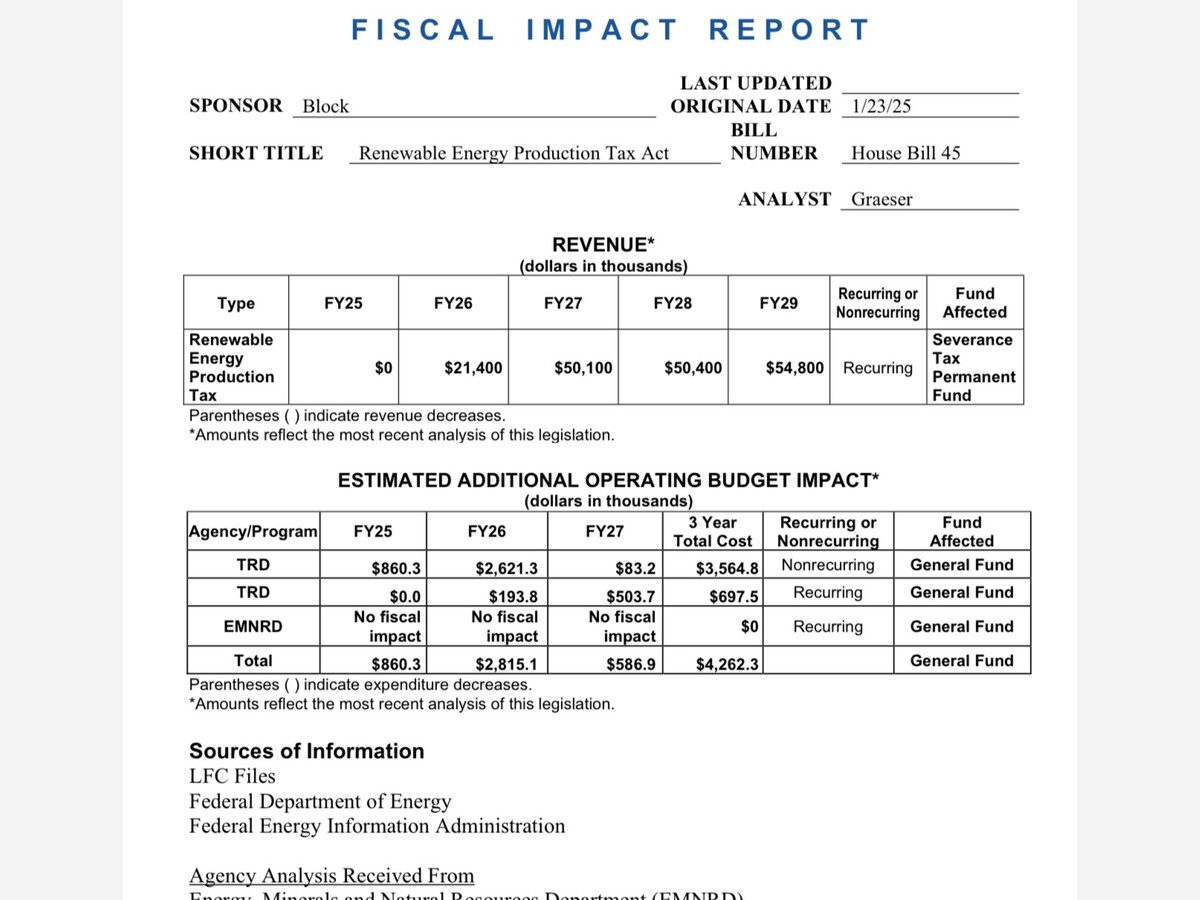

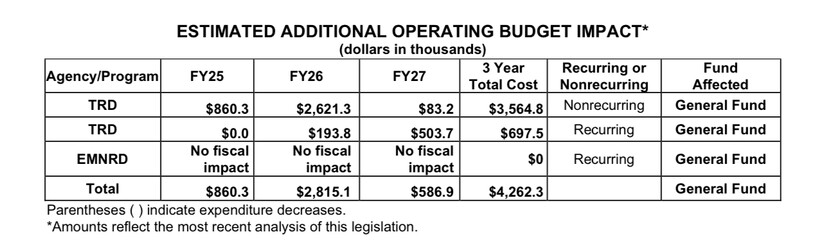

Both independent reports are a negative indictment on the John Block proposed tax increases as a boondoggle. The Block tax would cost the taxpayers $4.2 million to launch, is burdensome to administer due to it been widely variable as its not based on a flat contracted rate, and would negatively impact New Mexican households and small businesses "particularly those the least able to afford it."

Each analysis states it would cost the taxpayers at least $4.2 Million to establish the tax , and add an additional burden to New Mexico citizens in unnecessary taxes placing an especially troubling burden on low income households and small businesses.

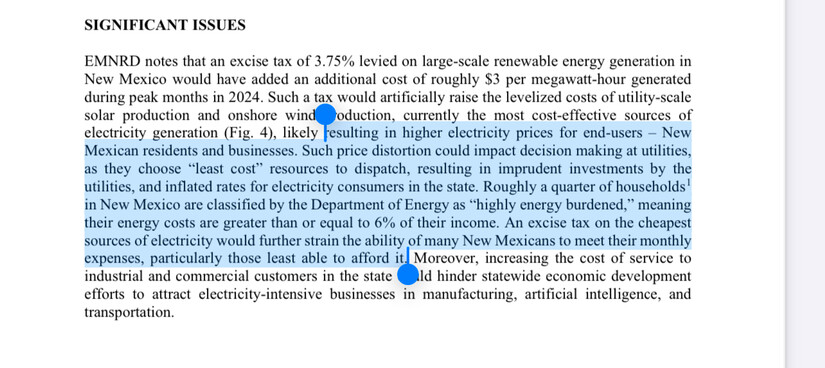

The analysis points out that such a tax "would artificially raise costs to production" and that 1/4 of New Mexico Households are considered "energy burdened" meaning more than 6% of households expenses are allocated to energy consumption, as such the Block Energy Tax would "result in higher energy costs for end users" thus "further strain the ability of many New Mexicans to meet their monthly expenses, particularly those the least able to afford it."

New Mexico Representative John Block was elected as a Republican fiscal conservative and yet has jumped on the Santa Fe establishments bandwagon of increasing taxes on small businesses and New Mexican Households. The New Mexico legislature has now proposed a tax increase on wages that employees and employers would have to pay further stressing take home pay via House Bill 11

Establishment New Mexico political representatives, to include Rep. John Block, have sponsored tax policy proposals, to reduce New Mexicans take home pay with a payroll tax, and then adding insult to injury, Mr Block expects individuals to then pay an additional "$3 per megawatt hour of energy generated and used" or 3.5% more on the expense to cook, heat and cool their homes.

Commentary:

Note: Local Senators Paul and Townsend, to date, have NOT supported these proposed and burdensome tax increase assaults on New Mexico households and small businesses.

Concerned and outraged taxpayers that believe New Mexico households are already overtaxed, and that no new taxes should be considered, given the $892 million budget surplus and $3.1 Billion in reserves; should write letters to the editor of local news organizations, as well as call and email John.Block@nmlegis.gov, Rep. John Block directly, with outrage over proposals to increase the tax burden on New Mexico's taxpayers.

If Rep. Block was a legislator with the public's interest at heart, he should have proposed a 3.5% decrease in oil excise taxes further benefiting New Mexic households and small business instead of an renewable energy tax increase that impacts our monthly home heating and cooling expenses.

In this period of a dozen eggs nearing $6 a dozen and more New Mexico households cannot afford to pay additional taxes. No new taxes, New Mexico!

You're surprised? The kid has a 3rd-rate degree and NO experience. He won because he I.D.ed a district without opposition. Plus as a pickle sniffer he misled us all. Time to go, but who'll run?

If a Republican is for it you you bet it will be bad for the people.