Image

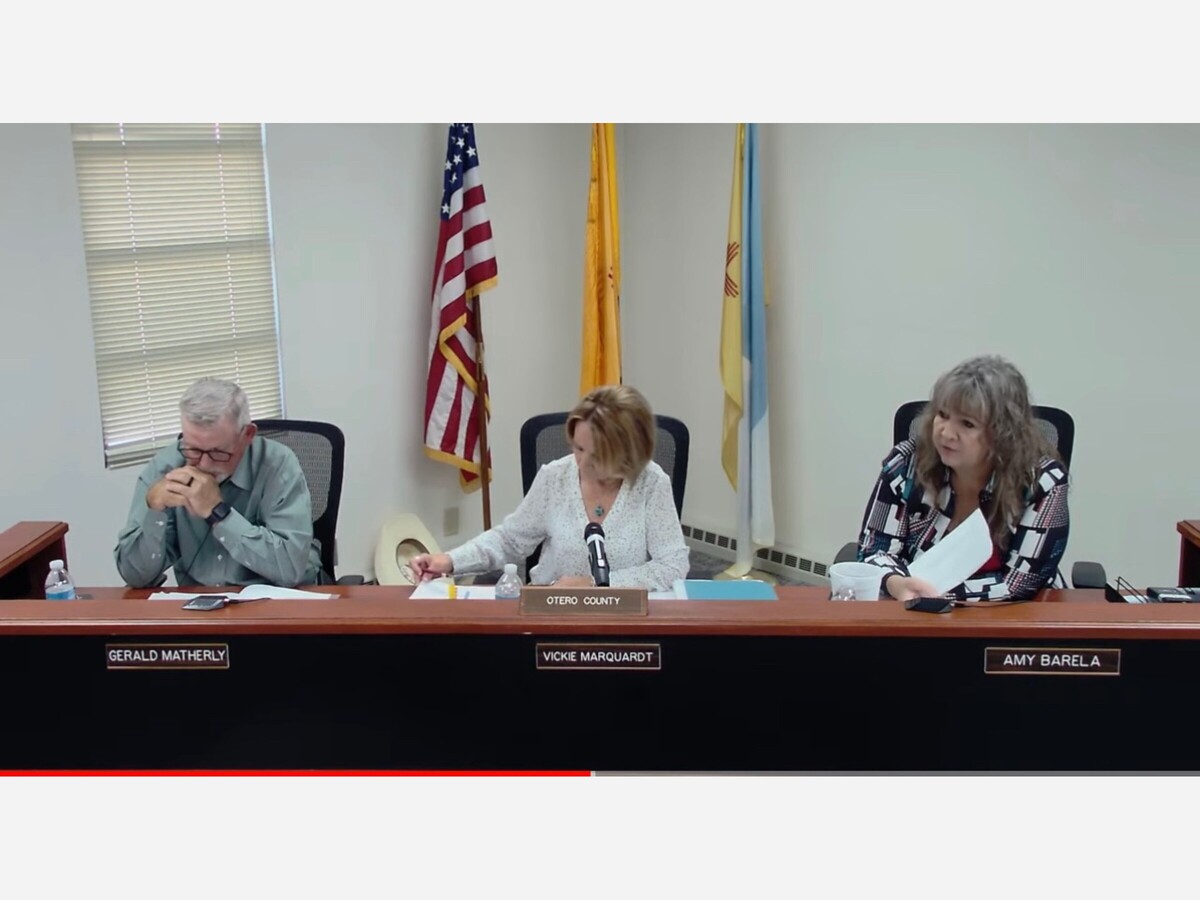

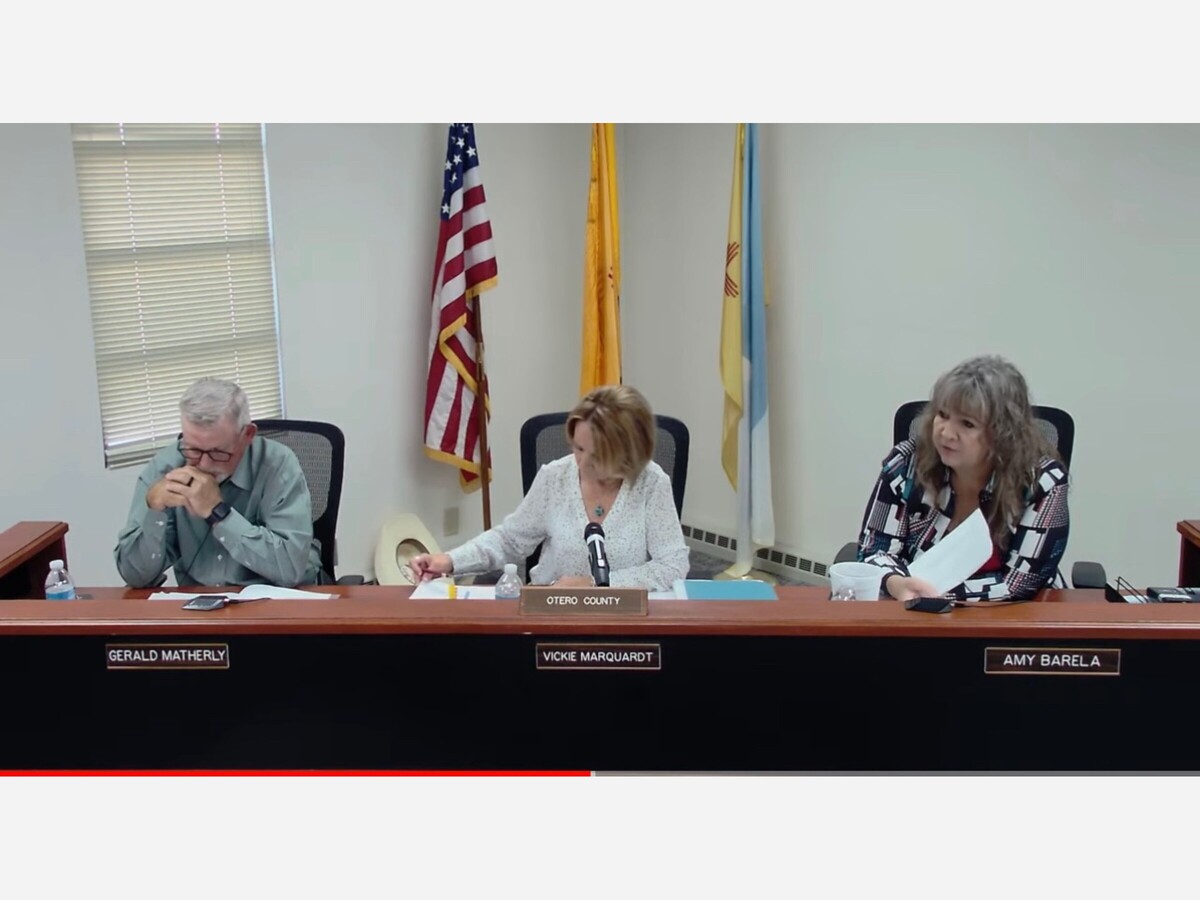

The Otero County Commission met in special session August 29th, 2023 to discuss Ordinance 23-2 for a gross receipt tax for Otero County.

The meeting began with the county attorney R.B Nichols explaining that by passing salary increases his expectation was that the county would then pass a tax increase. He claimed he was surprised that there is " discussion over the increase" as his expectation was that with the pay raises the tax increase needs to be considered and looked into.

He explained that,” Chaparral needs to be incorporated. It is now almost the size of Alamogordo and its needs need to incorporate, up and until, they incorporate it is the county responsibility. There has been an expansion of services, the animal shelter is at capacity and many animals are being killed.” He claimed he prefers lower taxes but we can't afford to services with the present income without a tax increase. Chavis, McKinley counties have higher taxes in comparison.

County staff member, R.B. Nichols claimed either the public doesn't care or has no complaints over the increase in tax increase. He encouraged it not to go to the voters, he said, "if it goes to the voters there is an 89% chance it will be voted down. If you send it to the voters and it does not pass then you can't increase the tax for a year. Passing the buck to the voters does not work."

There was NO one in attendance to make public comments either for our against the increase.

Marquette claimed that if someone spends "$100 dollars the impact is just 19 cents to the individual". She then blamed the governor for "reducing the tax rate" claiming it negatively impacts the county.

RB Nichols also expressed that relying on grants is a problem because when applying for grants "inclusion, social justice, equity and diversity" are considerations and "nothing is free, receiving money from the federal government is like making a deal with the devil and comes with its own requirements that are saddled upon you...GRT money allows the county to use it as the county sees fit...If you attempt to make a case to the taxpayers, they want their cake and eat it too. We can't make money for services magically appear. We either have to tell them sorry, you get what you get, of if you want more that comes with shared costs, and out of town guest pay it too."

The county staff recommended the tax increase without a voter referendum. The ditch crew expenses were discussed quite a bit as a reason for an increase and for not dedicating dollars to the ditch crew. Amy Barela suggested that the county cut expenses and that the county apply for grants as that is Federal Money that is out there and is available and Otero County should take advantage of that Federal Money that is out there. If we don't get it others do and Otero County looses out.

Commissioneer, Amy Barela suggested that "we can be tighter and trust the voters to make the decision. The ditch crew expenses could be covered with grants for equipment and belt tightening." Barela claimed she is willing "to champion an increase by going to rotary and public meetings and encourage it to pass." She felt strongly the voters should vote on any tax increase.

Commissioner, Gerald Matherly suggested the "county is a service provider and you have to stay up with the times." He suggested increases "such as copper, studs etc have increased significantly. The budget is under budget but $1.5 million could be fill several needs. Alamogordo residents would probably vote against it as they aren't impacted like those in the county." He suggested that it "does not have to go to the voters unless it were 1% or greater, that the commission has the authority for a 3/16% increase.

Commissioner Vicki Marquardt did not engage in much of the discussion other than to blame the governor for what is technically a local issue. "The amounts are so small and so minimal I would be in favor of the 3/16th increase and not send it to a vote, my nature thinks send it to the voters but if doesn't pass then things won't get better around here. I don't care for property taxes going up and this tax is more fair."

Amy Barela suggested if it goes to ballot the wording could include that money would be dedicated to blight. She said, "when I look at the spending we have, and I look at payables every month we could cut it. Over the last month we spent over $1500 on exercise equipment, we spent thousands of dollars on desks, we can repair some desks for a few years, we gotta make it happen. We can stop the spend."

The motions were one approve and increase in the tax. Amy Barela made the motion to consider a 3/16th's tax. The motion carried 3 for zero against.

The next question was to consider rather to put it on the ballot or just them as a commission pass the tax increase. The motion was made by Marquardt to NOT put it on the ballot and just impose the tax. The motion passed 2 for and 1 against. Barela voted against the commission believing that it should be on the ballot.

After the vote, Marquardt lectured Barela "we are going to be in a bind if this did not pass. It's not easy." Barela responded, " I get both sides, it's not easy, it's easier to just pass the tax. I'm still going to put my due diligence in and look at cutting the budget more, this is not an excuse to spend."

Thus a republican county commission passed a 3/16th's tax increase for Otero County residents rather than send the proposal to the voter.

Commissioner Barela consistent in her approach in letting the voters decide on tax increases, and trusting the voters over government, was in favor of the increase, but believed it should go to the voters. She voted against the commission approved increase. The increase was approved, on a 2 to 1 vote.