Image

Climate Week ran the week of September 20th thru the 26 and that naturally brought dialog of sustainable investing into focus so some concerned investors.

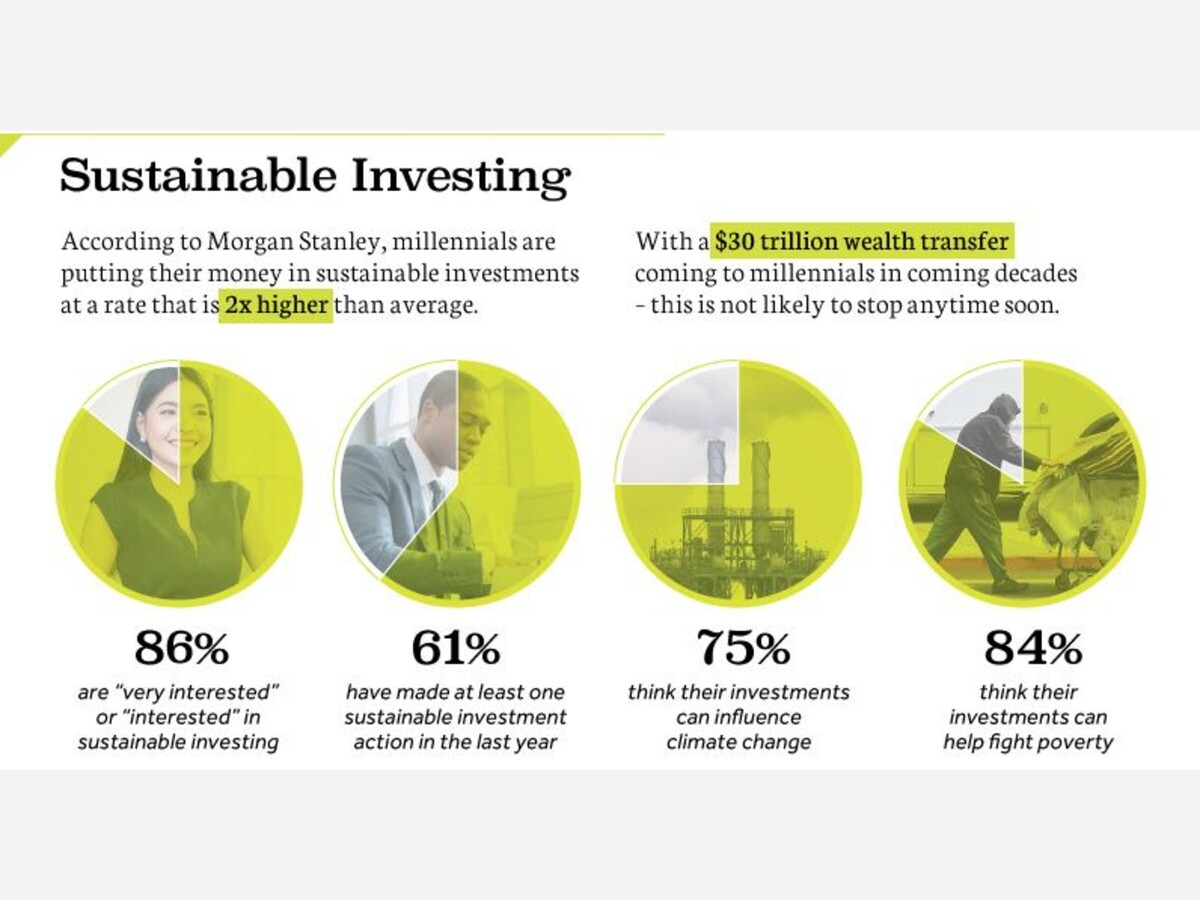

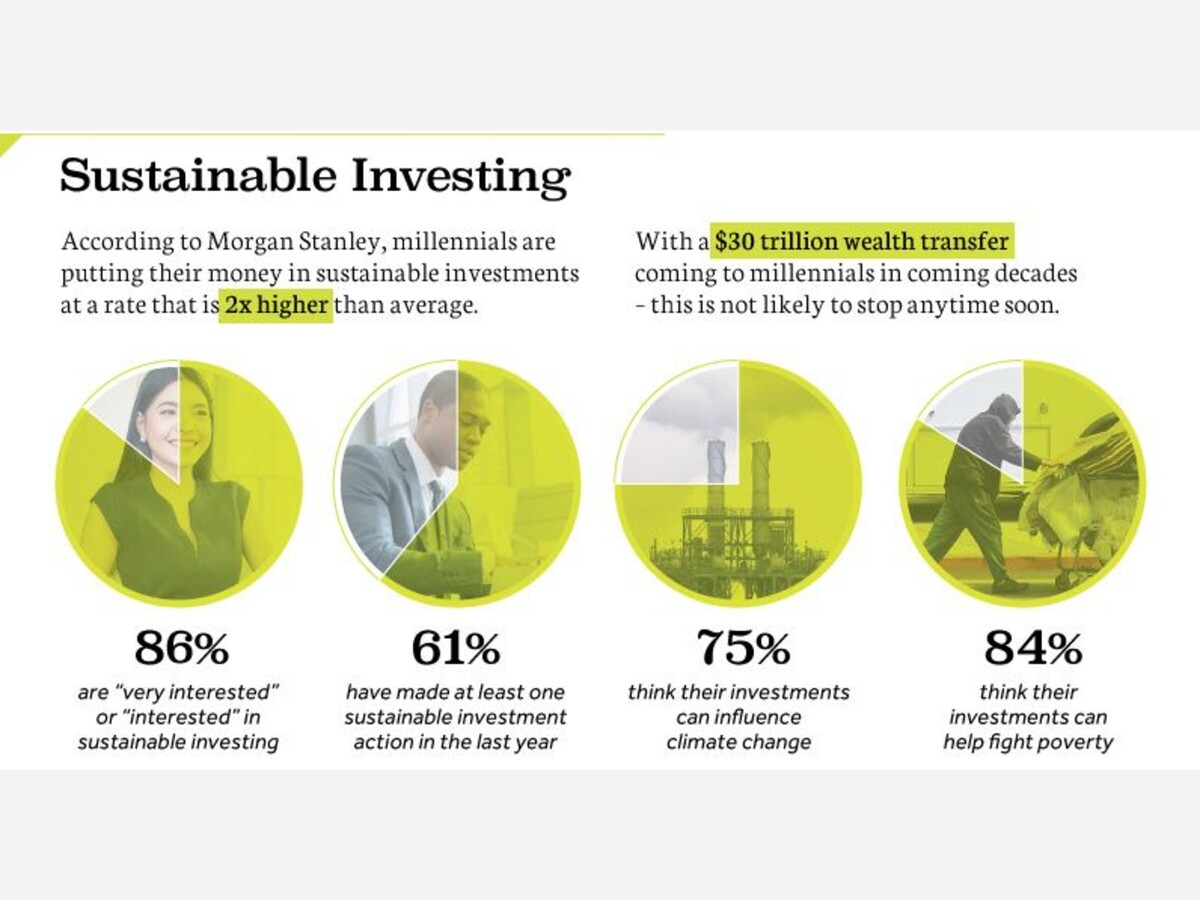

It's not niche: 85% of individual investors are interested in sustainable investing, and one out of every four investing dollars globally is following some form of it.

Oh you never heard of sustainable investing? It's not just a California thing.

Here is an overview....

Sustainable investing means including not just financial factors but also environmental, social, and governance (ESG) criteria when you analyze an investment. It rests on the idea that companies are more likely to succeed and generate a strong return if they provide value to all their stakeholders from employees to customers to the broader community.

With increasing attention and emphasis on sustainability issues related to public health, climate change, and social justice, ESG factors can help you understand an investment’s risk, opportunities, and social impact more holistically.

Sustainable funds outperformed comparable traditional funds and helped reduce investment risk during the COVID-19 pandemic in 2020, a recent study by Morgan Stanley found.

Financial institutions are integrating sustainable practices into their portfolios in record numbers, making ESG investing more accessible to individuals than ever before. In fact, 80% of institutional asset owners have actively integrated ESG factors into their investment process.

According to Morgan Stanley There are Risks and Opportunities from Climate Change...

As extreme weather events make global headlines and scientists warn about a shifting climate, more investors are thinking about environmental risks and how they might affect their portfolios. After all, global sea levels have risen nearly eight inches since 1880,1 a process that is rapidly accelerating2 and threatening major global cities like Jakarta, Lagos, and Miami.3

But it’s not necessarily all doom and gloom. Investors have an opportunity to play a role in bringing about change, and that can include managing for factors related to transitioning to a low carbon economy.

Here are four significant business risks associated with climate change and some ideas for how to help mitigate them through investments.

Risk: Physical damage to buildings, supplies, and equipment as a result of flooding or other extreme weather events can be costly. These events can also disrupt business by halting manufacturing or making it impossible for employees to get to work.

Opportunity: Companies around the world are preparing for climate change and as a result, they are investing in resilient buildings that can better withstand damage from storms, strong winds, and flooding.

Developing countries may offer investment opportunities in new construction and infrastructure projects that are built to hold up under extreme weather events. In the US, investments can include companies that help refit existing buildings and reinforce energy infrastructure for more resilience.

For investors, the opportunities are twofold: energy conservation within existing infrastructure in developed economies, and integration of resource efficiency in new commercial construction in emerging markets. A recent study of the construction industry found that nearly half of companies expect that green building projects will account for more than 60% of their work by 2021, up from just 27% in 2018.4

Risk: Companies that stick with processes and products that are seen as environmentally “dirty” can miss out on new opportunities for growth.

Opportunity: Look for companies that are on the leading edge of creating products that better the environment and also help other companies get out of heavy carbon emitting industries.

As economies around the world transition to lower carbon economies, investors could benefit from reducing their exposure to traditional energy sectors, investing in funds and companies that are positioning themselves for this transition, or focusing on specific themes such as renewable energy, biofuels, and green hydrogen, or innovative technologies such as electric vehicles and carbon capture and storage.

Consider these facts: Renewable energy sources are now cost-competitive in many markets. The cost of utility-scale solar energy decreased 17% from 2018 to 2019 and has fallen more than 80% since 2010.5 Wind and solar now account for 56% of global electricity generation, but these clean technologies, along with batteries, will comprise 80% of the $15.1 trillion invested in new power capacity over the next 30 years.6

Risk: Customers may avoid a company that is involved in an environmental or public relations crisis.

Opportunity: Diversify across all sectors, but with an eye toward companies with the best quantitative and qualitative disclosure and management practices.

One approach is to invest across all sectors of the economy—including traditional energy—but only in companies that have industry leading environmental, social, and governance (ESG) practices. That might mean investing in companies with sound corporate climate policies in place, or those that disclose their carbon footprints as well as disclose reduction targets over time. With regard to the environment, a number of companies have made sustainability pledges, such as achieving carbon neutrality by a certain date, relying more on alternative energy, or cutting usage through efficiency.

This also can include companies with better safety records and more diverse boards. By investing in companies from a best-in-class environmental, social, and governance perspective, investors may be able to eliminate the worst offenders and position their portfolios in leading sustainable corporate practices across various industries.

Risk: A shortage of drinking water or food can affect companies in parts of the world prone to droughts, heat waves, or pollution.

Opportunity: Explore sustainable and resilient agriculture and water infrastructure. Alternatively, carefully evaluate companies with operations tied to parts of the world where food or water could be scarce and avoid them if the risks are too great.

In the US, heat waves and drought greatly affect agricultural production, including corn, wheat, soy, and cotton. Without adaptation, estimates show that agricultural profits for common crops could fall 30% by 2070, thanks to climate change.7

For those looking to bring a sustainable approach to their investing strategy, there’s more than one way to go about it. In addition to exploring individual companies that may be pushing the pace on the opportunities listed above, investors could also look to sustainable funds or thematic investing. There are plenty of mutual funds and ETFs that reflect ESG and socially responsible investing (SRI) principles, as well as investing themes that highlight specific economic and environmental trends, from innovative vehicles to clean energy and water.

It’s not just for the equity side of a portfolio either. Investors can explore bonds of companies with sound environmental policies or “green bonds”, whose proceeds have a stated purpose that will seek to promote climate mitigation activities or other environmental sustainability projects. The opportunity in green bonds is vast, with issuance now exceeding $1 trillion.8

The most important thing, ultimately, may be realizing there is potential for action. Climate change poses a complex, systemic global challenge, but its risks can be mitigated and an investment portfolio, no matter the size, can play a role.

Is sustainable investing something for our readers to consider? Check with your financial advisor but note corporations large and small are concerned with the economics of climate change. As individuals and politicians want to debate and deny its existence 1/4 of the worlds largest corporations have invested much time and analysis and put mitigation plans into growth and capitals as a result of the threats from climate change.

Closed minded individuals may want to debate rather it is indeed relevant, but here is the fact we should consider, trillions of dollars are at risk from it or could be gained with proper positioning from it. The worlds largest corporations are taking the threats and opportunities serious.

If the largest companies of the world take it serious why would not the common investor as well as local government officials and small businesses?