Image

Fact verses fiction on the Budweiser controversy and their stock prices. A propaganda piece, Twitted from the propaganda blog of a local state representative, aimed directly to feed his base, would lead one to believe Budweisers business is negatively hampered and facing huge losses.

The propaganda alludes that valuation is down due to efforts and calls for a boycott due to politically liberal leanings of the brand.

The propaganda piece eludes to a $5 Billion dollar valuation loss and attempts to attribute it to a call for boycott. However let’s see the historic trends of this stock and how it’s trending this year.

Year to date the stock is up 5.56% and over the last year it’s up 8.19%. Looking at the trend line it’s up significantly since October of last year when it was trading at around $44 dollars, during evening trading tonight it’s at $63.37 not far from its yearly high of $67.09

Let’s take a look at Anheuser-Busch InBev (BUD) (OTCPK:BUDFF), which has a liquid ADR listing.

Anheuser-Busch InBev is one of the best-margin consumer companies around the world according to most stock analysts.

You could say it dates back to 2004, when Belgian brewer Interbrew and AmBev, Brazil’s biggest brewing company, merged. That single move created InBev, the world's largest beer brewer – a title it has kept ever since despite another merger and another name change.

That next step was taken in 2008, when it acquired Anheuser-Busch, the largest brewer in the U.S. at the time. Hence its current name. Though it wasn’t done from there.

It purchased Grupo Modelo, Mexico's leading brewer in 2015. And it also swallowed up SABMiller, then the world's second-largest brewer.

The resulting corporation owns a mind-blowing 33% of the global volume of beer. So it’s no surprise that it manages profit margins that leave most competitors in the dust.

Anheuser-Busch InBev is the very definition of vertical integration and economy of scale. And it's in a near-unassailable overall position of dominance in terms of volumes.

The revenue the company generates in beer sales is huge it boasts a 47% U.S. market share, 67% for Brazil, and 59% for Mexico.

These key markets together generate almost half of Anheuser-Busch InBev’s $100 billion plus in annual sales.

Despite controversy and its losses over the previous week, BUD remains firmly in the green for the month and is still up almost 9% year-to-date. For a global brand regional controversies and marketing ups and downs are built into business forecasts.

Any brand or business up 9% year to date is not too shabby given the pressures on the American consumer and rising expenses for food. Beer is a nice to have not a must have verses eggs or water.

Before writing off BUD stock, it’s important to note a few things..

Firstly, Anheuser-Busch isn’t the only industry giant to partner with Mulvaney. Nike (NYSE:NKE) recently offered her a partnership even as the Bud Light controversy swelled. TIME reports that Nike has responded to the controversy by stressing the importance of kindness and inclusion. And NIKE stock is rising today while BUD struggles. This suggests that the beer company’s problems may not be entirely due to its work with her.

Secondly, Bud Light belongs to a company with an unmatched range throughout its industry. While rumors of a boycott have been circulating since Mulvaney’s video post, they likely don’t mean investors will panic nor even blink an eye on reality. Most investors in large corporate stocks are institutional investors and as such they ignore the media hype of the moment and look at long term company fundamentals and earning prospects in a global economy.

Even if a chunk of its US consumer base stops buying Bud Light, Anheuser-Busch has plenty of other beers, 300 plus, to keep it in the green. It is global brand with more revenues generated overseas than domestically and that revenue is growing by leaps and bounds!

The company also produces iconic names such as Budweiser, Stella Artois, Shock Top, Karbach, and many more.

Boycotting the entire company would lead a US shopper with very few options from the beer aisle. It is, therefore, improbable that a company-wide US boycott could succeed not even happen.

It’s a global company. As calls for a boycott intensify in the US growth from in Mexico, Brazil and Latin America increase thus countering the losses, as rebellions against that element of U.S. society.

For all the criticism that Anheuser-Busch is facing now, this fad isn’t likely to last long. It is even less likely to impact the company’s long-term growth prospects as a global brand.

Think for a moment the irony, even the people who purchased Bud Light to make a protest video; guess what they still had to spend money on it.

Additionally, BUD stock is the type of company that can withstand unfavorable market conditions in the US given its global reach and global sales.

The far-right will soon find something else to be angry with, and when they do, shares will continue further into the green. Some say any press is good press for an iconic brand. Controversy In marketing keeps a brand top of mind, and long term builds growth.

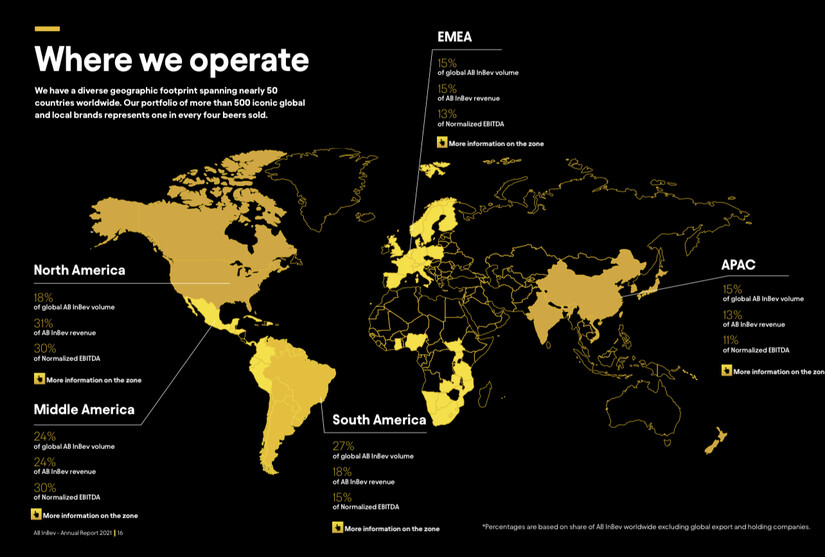

Global Presence:

Diversity and Inclusion is part of the company culture:

Jobs to consider! When there are calls for boycotts and attacks on American based companies just remember it’s the delivery driver, the bartender, the farmer, or the locally owned restaurant or bar you are harming not “the global juggernaut” of brewing.

So let’s all calm down, smoke something or pop open bottle or can and celebrate the local jobs created verses attacking a proud iconic American brand.